We’re strategic and hands on, identifying each asset’s opportunities, mitigating the risks, and focusing on value creation at each stage in the asset and property management process.

Proactive and disciplined asset management is embedded from the outset

Asset Management Strategy

Because we invest and develop for the longer term, asset management is considered from the start. Identifying assets and opportunities early mitigates risks during the investment phase and informs value creation during development. With this proactive approach, we realize projections and improve properties as conditions evolve.

We take a balanced approach

We identify and create opportunities while executing prudent strategies that achieve long-term value and sustainable returns. We make decisions (both long and short-term) with the same philosophy in mind: we focus on the details that add value; enhance quality and community; and demonstrate a positive return on investment characteristics.

We sweat the details

From the underwriting of an acquisition target to our evaluation of specific unit improvements, we perform detailed return on investment analyses to assess the costs and benefits associated with each execution, no matter how large or small.

We use our creativity—and our analytics

Our marketing and lease-up strategies are customized for each property to drive traffic, capture interest, and close deals.

Execution

Multifamily Portfolios

Transaction Highlights

Use: Multifamily (w/ retail)

Neighborhood: San Francisco

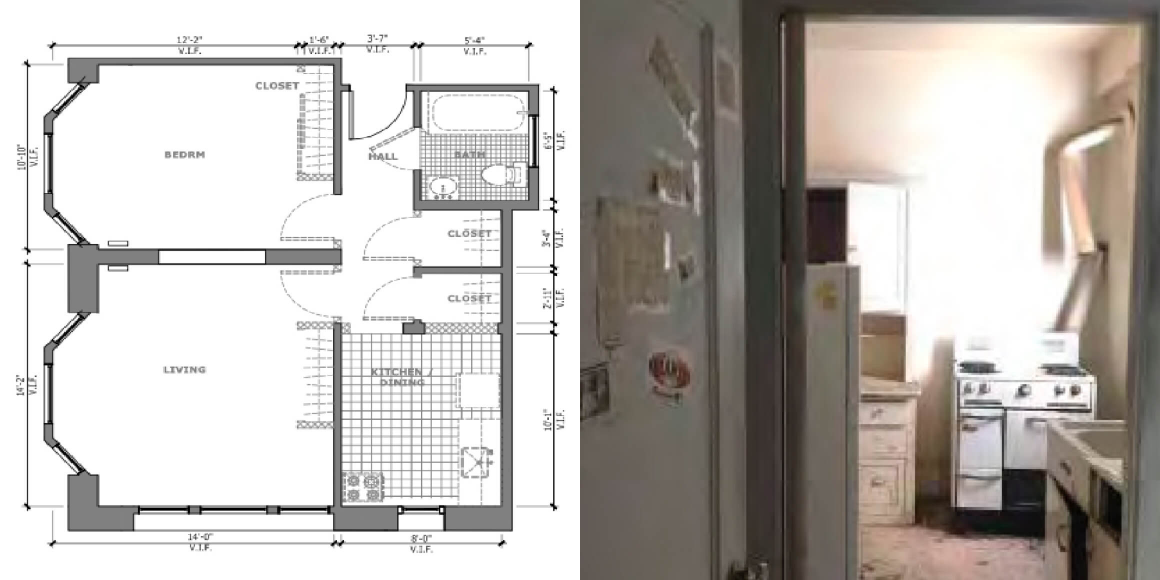

Before

After

Strategy

- Two multifamily portfolios comprising 913 total units, the portfolios spanned 23 properties across 10 neighborhoods, representing an unprecedented opportunity to invest in a diverse cross-section of San Francisco multifamily properties

- Prado and its partners were able to purchase two apartment portfolios off-market directly from special servicers in two separate transactions

Execution

- Employed value-add strategies, including unit renovations and unit conversions, which increased cash flow and made the apartments more competitive with newer construction

- Activated the ground floor retail spaces in many of the properties, creating additional amenities for residents

Results

- Prado successfully recapitalized both portfolios with a university endowment in 2016

- Prado ultimately sold portfolios in 2018

Value Add

1401 California

Transaction Highlights

Use: Retail

Neighborhood: Nob Hill, SF

Strategy

- Prado identified an underutilized site with a grocery store that was planning to vacate

- Through an attorney relationship, Prado was able to purchase the site off-market

Execution

- Acquired two separate interests from feuding family members

- While the site allowed for a large mixed-use development, Prado felt that the re-lease of the building created the highest risk-adjusted return

- Prado adaptively reused the building, which was renovated, subdivided, and re-tenanted with Trader Joe’s and CVS

- Obtained Formula Retail Conditional Use approval within three months of initial filing

- Updates included adding an elevator and stairs to improve vertical circulation from the lower parking area to the store and renovating the facade

Results

- Prado achieved the highest grocery and drug store rents in the market for both Trader Joe’s and CVS

- Prado was also able to reduce tenant control to allow for optionality of future development (max of 25 years)

- Trader Joe’s was operational within 12 months of Cala Foods’ departure

- Prado successfully refinanced the property in 2012 and returned all invested equity

1221 Jones

Transaction Highlights

Use: Multifamily

Neighborhood: Nob Hill, SF

Strategy

- Secured one of the high-quality San Francisco assets off-market through a combination of a direct relationship with the seller and prior experience with the seller’s broker.

- The 72-unit rent-control property boasts coveted views of the Bay Bridge, Golden Gate Bridge, Grace Cathedral, Mount Diablo, and Huntington Park and as well as subterranean parking.

- The property is an irreplaceable institutional quality asset given a 14-story high-rise view property is not possible to build today at the top of Nob Hill.

- The property was acquired through a joint venture between Prado Group and Felson Companies.

- We are acutely aware of market conditions and the valuation of this asset and continue to evaluate value-add strategies including unit renovations and conversions.

Tenants

Peet's Coffee

Barry's Bootcamp

Faherty

Herman Miller

- Peet's Coffee

- Barry's Bootcamp

- Faherty

- Herman Miller

Trader Joe's

CVS

Starbucks Coffee

Giorgio Armani

- Trader Joe's

- CVS

- Starbucks Coffee

- Giorgio Armani

Madewell

Marine Layer

Sweetgreen

Joe & the Juice

- Madewell

- Marine Layer

- Sweetgreen

- Joe & the Juice