Strategy

- Two multifamily portfolios comprising 913 total units, the portfolios spanned 23 properties across 10 neighborhoods, representing an unprecedented opportunity to invest in a diverse cross-section of San Francisco multifamily properties

- Prado and its partners were able to purchase two apartment portfolios off-market directly from special servicers in two separate transactions

Execution

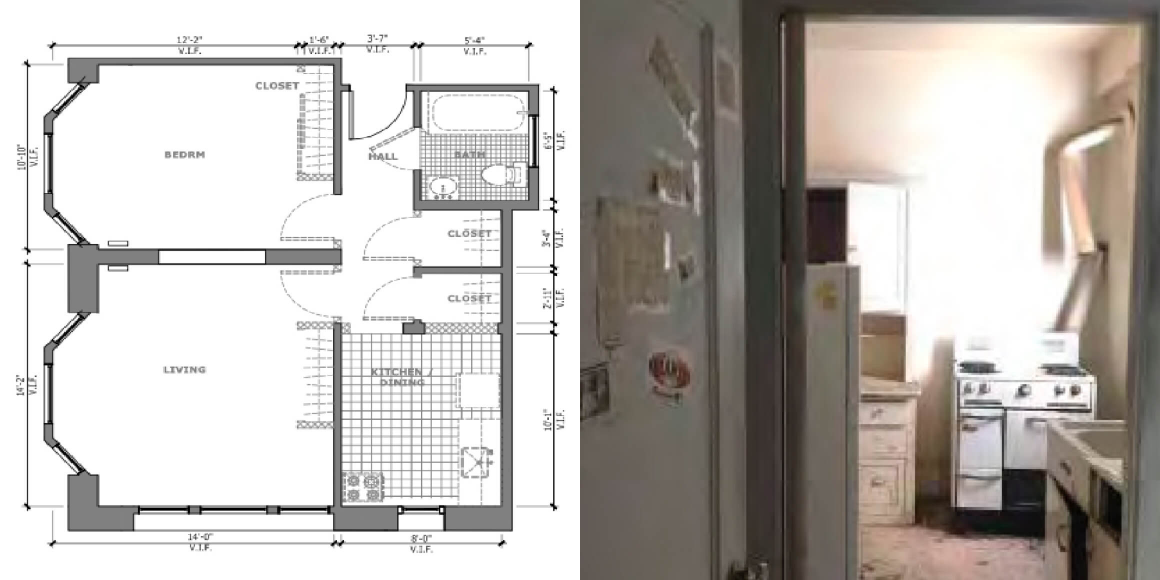

- Employed value-add strategies, including unit renovations and unit conversions, which increased cash flow and made the apartments more competitive with newer construction

- Activated the ground floor retail spaces in many of the properties, creating additional amenities for residents

Results

- Prado successfully recapitalized both portfolios with a university endowment in 2016

- Prado ultimately sold portfolios in 2018